How To Lower Your Homeowners Insurance Costs

Posted: July 2, 2019

If you own a home, homeowners insurance is an item in your budget that’s there to stay. Depending on the size of your home, location, and other factors, your premiums may be significant and could increase over time. However, there are ways to minimize the cost of homeowners insurance. Taking the following steps could help lower your premiums. Increase Your Deductible A deductible is the...

Does My Homeowners Insurance Cover Internal Damage?

Posted: June 18, 2019

When they think of homeowners insurance, many people have fires, storms, and natural disasters in mind. But what about internal damage, such as water leaks and mold? Are these problems covered? Your policy is likely to cover certain types of internal damage, but not all. Our knowledgeable agency will be happy to review your homeowners insurance policy and ensure you are covered for any eventuality....

Burglar-Proofing Your Property While You're Away

Posted: June 12, 2019

Summer is upon us, and while the appeal of warmer weather and lazy days gives us something to look forward to, it’s also enticing to those who make their living from breaking the law. According to a report by the Bureau of Justice Statistics, which is a division of the United States Department of Justice, crimes like burglary and larceny occur more often in the...

Protecting Your Home From Wind Damage

Posted: May 30, 2019

The end of May 2019 was a challenge for many residents of the Midwest as a series of violent storms spawned deadly tornadoes. Reports from Jefferson City, Missouri and Dayton, Ohio told tales of loss of life and financial devastation. Middle Tennessee made national severe weather news in late Fall 2018 when an F2 tornado touched down in Christiana, killing one woman when it tore...

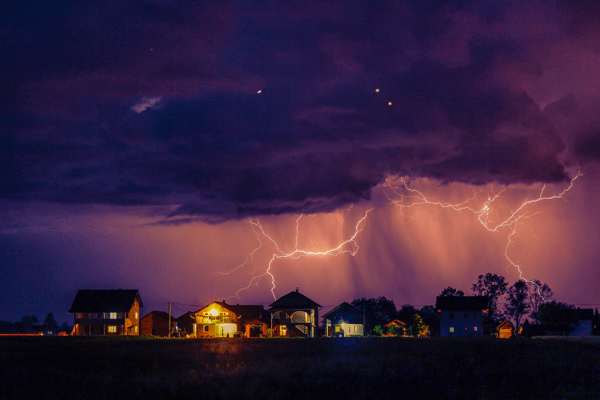

Protecting Your Home During Thunderstorms

Posted: May 27, 2019

Heavy thunderstorms can wreak havoc on a home. The following tips can help protect your property if you live in an area where storms frequently occur. Trim or Remove Trees Storms can snap off tree branches, which can damage your home or detached structures. Get your trees trimmed before the stormy season and cut down any trees that are unwanted. Unless you are confident you...